Matt Krantz, USA TODAY

image (not from article) from

Investors didn't see a big pay day last year since the stock market was flat. But some CEOs sure did.

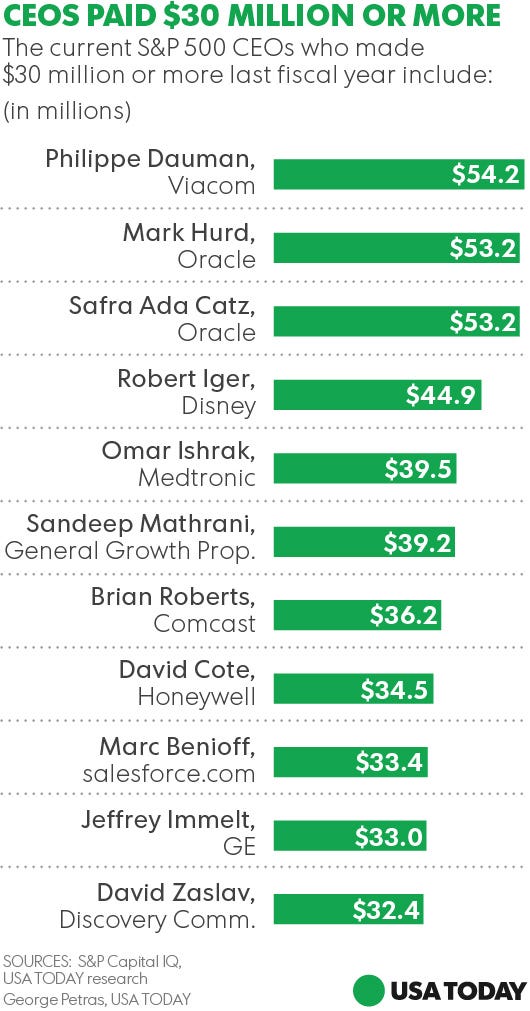

Eleven current CEOs of S&P 500 companies, including Philippe Dauman of media giant Viacom (VIAB), Marc Benioff of online sales software makerSalesforce.com (CRM) and Robert Iger of media powerhouse Disney (DIS), are members of the lucrative $30-million-a-year club, based on an analysis of data from S&P Global Market Intelligence by USA TODAY of the 418 CEO pay packages reported so far. Total pay package sums were tallied using the methodology required by the Securities and Exchange Commission .

Breaking the $30 million-a-year barrier was even more rare this year because the stagnant stock market stalled earnings growth, and anemic gains in pension values due to accounting changes put a lid on gains. In 2014, 22 of current S&P 500 CEOs made $30 million or more.

"These kinds of paychecks are really out of line," says Eleanor Bloxham, CEO of The Value Alliance, an advisory service for corporate boards and executives. These pay packages "are not just out of line with what shareholders are making ... (they are) causing negative effects on the economy."

The biggest pay package was awarded to Dauman to the tune of $54.2 million. That fiscal 2015 pay package was 22% more than the previous year's. Shareholders didn't fare nearly as well, with the stock dropping 44% and net income falling 19% to $2 billion in the same period. Viacom's regulatory filing shows that $17 million of Dauman's total pay was from a contract renewal. Excluding that renewal, Dauman's pay fell 16%, the filing shows. Viacom didn't respond to a request for comment.

Large CEO pay packages catch attention, but they might be easier for shareholders to take if they are gaining, too. Take Disney's Iger, who was paid $44.9 million last year. That pay package puts the CEO among the best-paid, but Disney's stock jumped 16% during fiscal 2015, which ended on Oct. 3, while Iger's pay actually fell 4% from 2014. A Disney spokesman said that 92% of Iger’s compensation is linked with financial performance. Disney's net income rose 12% last fiscal year to $8.4 billion.

Deciding how to measure CEO pay continues to be a topic of great discussion. David Cote , CEO of Honeywell (HON), was paid $34.5 million last fiscal year, up 18% from fiscal 2014. The SEC required the company to include pay Cote received connected with a growth plan that is actually paid over two years, says Rob Ferris, a spokesman at Honeywell. "This differs with how our compensation committee views this element of compensation, because the total payment is earned over two years and should be annualized, since performance cycles do not overlap," he said. Adjusted to an annual basis, Cote's total pay fell in 2015. Honeywell's stock rose 3.7% in 2015.

Some companies make a point to say they're addressing CEO pay. Salesforce.com's Benioff saw his pay drop 16% in fiscal 2015, which ended in January. But it still came in at $33.4 million, making him the fifth-best-paid CEO in the analysis. The company said in a regulatory filing that it made "significant changes" to Benioff's pay "taking into account feedback we received from stockholders." The biggest change replaces option-based incentives to a plan where 91% of his compensation is tied to achievements or is based on the stock's performance. Shares of Salesforce rose nearly 21% in fiscal 2015, while the company's net loss widened to $263 million.

Bloxham says that large pay packages, though, fuel a lack of engagement of rank-and-file workers and send the message companies are only what they are due to top executives. She criticized Iger's pay package in light of the fact the company's heir apparent, former Chief Operating Officer Thomas Staggs , announced this month he will resign. "What boards should be driving for are sustainable companies," Bloxham says. "The goal should be a company that could operate without the CEO."

No comments:

Post a Comment